How The Fields of Insurance and Finance Management Intersect

Understanding How Combined Insurance and Finance Management Experience Can Open New Career Doors

We tend to think of “insurance” and “finance management” as having two separate functions in our lives, but the two are actually quite interconnected, making up the larger Financial Services Industry. While overlaps such as bancassurance (the practice of banks selling insurance products) have been around since the 1970s, more recent practices and innovations have blurred the lines between insurance companies and financial firms even more, with both industries working closely and being interdependent upon each other. For individuals aspiring to enter Financial Services, as well as professionals who wants to move their career ahead, gaining knowledge in both Insurance and Finance Management builds a more valuable and in-demand skillset.

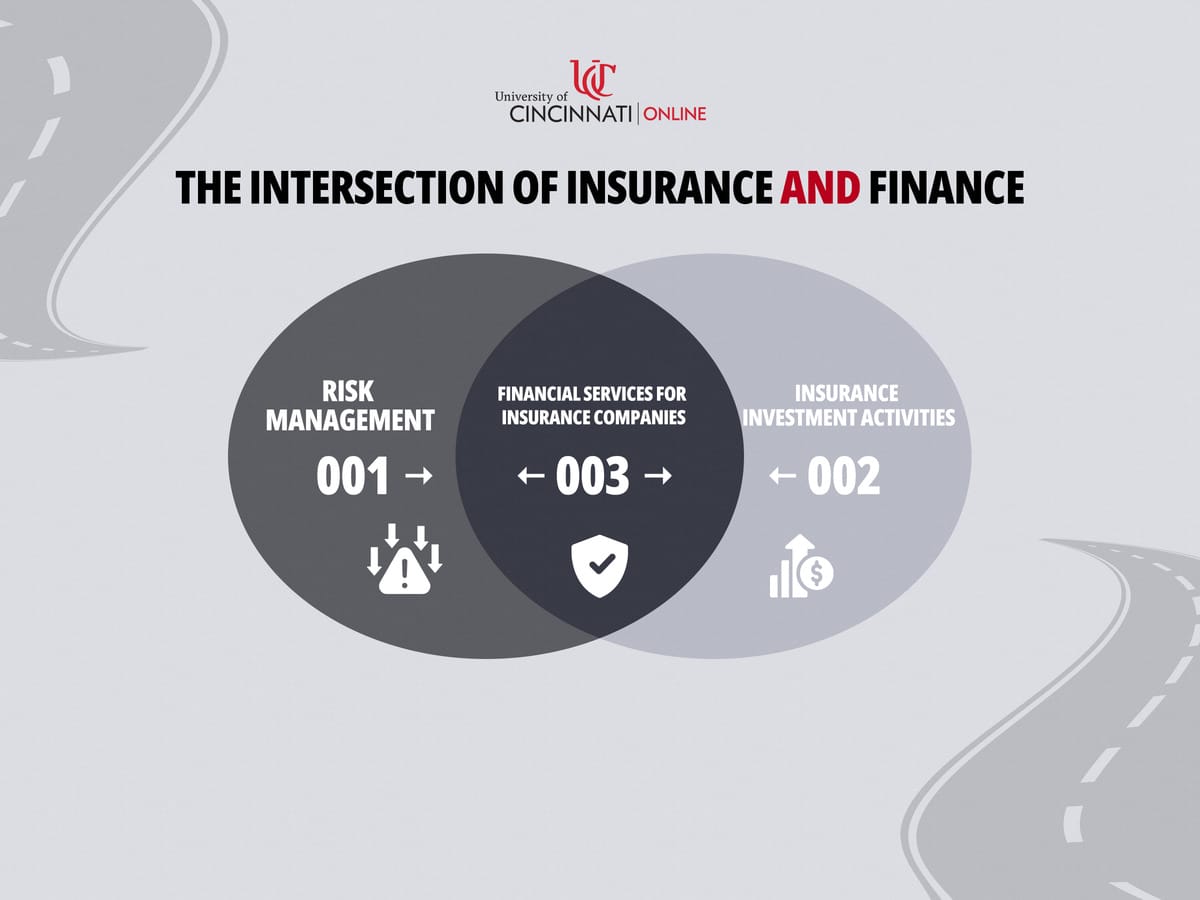

Risk Management

Managing risk is the name of the game for the field of insurance. Individuals and businesses are always at risk of financial loss from accidents, illness, property damage, and lawsuits. By collecting premiums from policyholders, insurance companies create a financial “safety net” that can be used to cover the financial aspect of losses when they occur, mitigating the risk for any one person or company.

- Individual Security: Insurance policies provide individuals with protection to cover not only valuable assets such as autos, homes, and jewelry, but also their own health and the welfare of loved ones who survive them. With insurance, we have the peace of mind that unexpected tragedies won’t cause financial hardship or ruin.

- Business Continuity: Insurance is essential to ensure that businesses can continue to operate through hardships or rebuild in cases of extreme loss. The future of the business and those who work for it are protected with insurance policies for property damage, business interruption, and liability change.

Financial Management also incorporates risk management, including working alongside insurance companies to benefit policyholders:

- Investment Potential: For the insurance industry to remain solvent, insurance premiums collected from policyholders must be invested to yield returns that will help meet future claims obligations. Insurance and finance companies partner as major investors, leveraging a range of financial options like bonds, stocks, and derivatives to optimize returns while managing risk.

- Creditworthiness and Lending: Insurance is a critical factor for many loans and other financial products. For example, lenders often require borrowers to have property/casualty insurance to protect the assets they are purchasing with the loans. Life insurance or disability policies can also be used for collateral for loans, reducing the risk for the lender.

Insurance professionals cross the boundaries into the finance management field, which highlights why individuals with knowledge in both specializations are so valuable.

Insurance Investment Activities

Along with risk mitigation, insurance providers also offer the opportunity to grow wealth, with products and services such as:

- Permanent life insurance policies can offer not only death benefits to beneficiaries, but also cash value accumulation to the policyholder. These policies essentially function as a savings vehicle with the added benefit of a death benefit for loved ones.

- Annuities provides an income stream in retirement, guaranteed for the policyholder’s lifetime. Annuities can be used as part of a retirement income strategy, complementing other retirement plans.

- Unit-Link Insurance Plans (ULIPs) combine insurance coverage with investment offers, providing protection and the added bonus of participating in market growth.

By offering these products, insurance professionals cross the boundaries into the finance management field, which highlights why individuals with knowledge in both specializations are so valuable.

Financial tools and highly trained finance experts play a critical role in ensuring the sound financial health and long-term sustainability of insurance companies.

Financial Services for Insurance Companies

Financial tools and highly trained finance experts play a critical role in ensuring the sound financial health and long-term sustainability of insurance companies. Financial service commonly provided to insurance companies include:

- Reinsurance, designed to allow insurance companies to share risk with other insurers. Reinsurance involves complex financial calculations and risk modeling, creating a strong link between the finance and insurance industries.

- Actuarial science, a field that bridges mathematics. statistics, and finance, is used to assess sophisticated financial models to determine risks, set premium rates, and develop new insurance products.

Technological Innovation Leads to More Overlap

As technology continues to change the way we work, several key trends are creating opportunities for the fields of insurance and finance to overlap in additional areas:

- InsurTech is a collaboration between insurance companies and tech startups to leverage technologies like Big Data, AI and machine learning to streamline insurance processes to personalize policies and offer new risk-based pricing models.

- FinTech companies are developing platforms that integrate insurance with other finance services to offer a holistic financial planning and allow clients to manage their insurance alongside investments, loans, and other financial products.

- Blockchain Technology, which stores data in chains of blocks that cannot be altered or modified, is being explored for secure data management, automated claims processing, and fraud prevention. This technology offers the potential for enhanced efficiency and transparency in both insurance and finance.

By combining finance and insurance knowledge, you unlock doors to a wider range of career opportunities, potentially higher earning potential, and a deeper understanding of managing your own financial well-being.

Why Professionals with Combined Insurance and Finance Skills are In Demand

A current skills gap in which available jobs are outpacing individuals with specialized insurance and finance management knowledge means that individuals who build skills in either specialization have abundant employment options. And those with skills in both areas broaden their employment potential even further, opening up career opportunities in both the insurance and finance industries, as well as many other fields. By combining finance and insurance knowledge, you unlock doors to a wider range of career opportunities, potentially higher earning potential, and a deeper understanding of managing your own financial well-being. Broader Career Options: This unique skillset combination positions you for careers that not everyone can qualify for. The ability to understand financial risk and translate it into insurance solutions is valuable in both industries. Increased Demand: Roles like actuary, risk manager (insurance focus), and financial advisor (insurance specialization) are in high demand due to their specialized skillset. Potentially Higher Earning Potential: Careers requiring both finance and insurance expertise are often niche and well-paying. For instance, actuaries and financial analysts in the insurance industry tend to have higher salaries compared to general finance roles. Enhanced Job Performance: In finance, understanding insurance implications helps assess the financial impact of risks. In insurance, financial knowledge allows for better pricing of policies and managing investments. Strategic Planning: You can develop more comprehensive financial plans for clients (as a financial advisor) or design insurance products that are financially sound (as an insurance professional). Better Personal Risk Management: In your personal life, you can make informed decisions about your own finances and insurance needs. Understanding the Bigger Picture: You can see the interconnectedness of finance and risk management, allowing for a more holistic approach to financial planning and security.

Earn a Certificate in Insurance and Finance Management

Whether you aspire to enter the Insurance or Finance field, or a seasoned professional looking to add to your professional toolkit, building your knowledge in Insurance and Finance Management (IFM) is a great way to prepare to move your career forward. The University of Cincinnati offers a one-year Certificate in Insurance and Finance Management, which allows people to quickly upskill in this combined specialization. For more information, visit online.uc.edu/ifm.

Frequently Asked Questions

Q: What entry-level finance-focused careers exist in the insurance industry?

A: The insurance industry relies heavily on financial expertise to manage risk, price policies, and ensure its own financial health. A few entry-level finance-focused career paths in insurance include:

- Actuarial Analyst

- Financial Analyst

- Insurance Underwriter

- Insurance Accountant

- Claims Adjuster

Q: What entry-level insurance-focused careers exist in the finance industry?

A: The finance industry also has a need for professionals with insurance expertise. Here are some career paths that demand insurance expertise in the field of finance:

- Risk Analyst (Insurance Focus)

- Insurance Broker (Financial Services)

- Financial Analyst (Insurance Portfolio)

- Insurance Sales Agent

- Insurance-Linked Securities (ILS) Analyst

While these lists are not exhaustive, they highlight some interesting career options for professionals with a combined background in insurance and finance. The specific roles and their requirements may vary depending on the financial firm or insurance company and its area of focus.